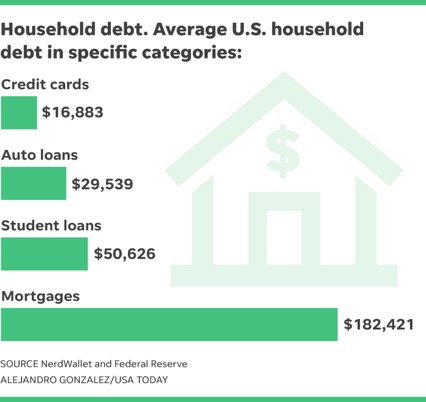

Did you know that in 2017, “the average American household carries $137,063 in debt” and yet the median income was only $59,039? (USA Today).

In this day and age, basic financial know-how is essential. But most of us don’t know and have never been taught how to do basic finances. So, how do we learn without making some potentially major financial mistakes? In this article , we are going to discuss the Dave Ramsey method and how it can apply to you as a college student. Dave Ramsey is one of the leading professionals in helping people get out and stay out of debt.

First, you might be wondering “what does this guy know about finances”? Well, hear it from the man himself!

“Starting from nothing, by the time I was 26 I had a net worth of a little over a million dollars. I was making $250,000 a year. That's more than $20,000 a month net taxable income. I was really having fun. But 98 percent truth is a lie. That 2 percent can cause big problems, especially with $4 million in real estate. I had a lot of debt—a lot of short-term debt—and I'm the idiot who signed up for the trip.

The short version of the story is that debt caused us, over the course of two and a half years of fighting it, to lose everything. We didn't tell anyone what was going on, but if we had to do it again, we would learn from the wisdom of others who have been through it. We soon learned that we were not the only ones at the bottom. Barbie and Ken (you know, the couple who appear to be perfect—perfect clothes, perfect car, perfect house) are broke, and I don't take financial advice from broke people anymore.”

After he lost everything, Dave set out to figure out how to take control of his money so this would never happen again. He wrote his first book and began a radio show called The MoneyGame which is now known as the Dave Ramsey Show. Dave has helped thousands of every-day Americans get out of debt and stay out of debt. In this article, we are just going to highlight Dave’s major methods but to get more details, information, and tips, we highly recommend visiting Dave’s website or reading his book The Total Money Makeover which highlights and goes more into depth with the Seven Baby Steps. Dave also offers other books on a variety of financial topics, so be sure to take a look.

Dave Ramsey’s beginning process for getting out of debt are the Seven Baby Steps. Those steps are as follows.

Baby Step 1: Save up $1,000 in an emergency fund

Baby Step 2: Pay off all debt using the debt snowball

Baby Step 3: Save up 3-6 months worth of expenses in a separate emergency fund

Baby Step 4: Invest 15% of your income into retirement

Baby Step 5: Save for children’s college fund

Baby Step 6: Pay off your home

Baby Step 7: Build wealth and give

Now you might be wondering how this applies to you. I wondered that too when I started this because most of these steps seem like they are geared towards people who are past college and into their careers. But these steps can still help you and apply to you as a college student. The first step you can take as a college student is to limit your debt as much as possible including choosing a cheaper college, limiting your student loans and considering not using credit cards. First, consider your school of choice: do you really need to attend an out-of-state school or a private school? The average college cost in 2019 is $10,116 for an in-state public school, $22,577 for a public out-of-state school, and $36,801 for a private school according to US News. There are many public schools that have programs that are just as good but at a significantly cheaper cost to you.

When it comes to paying for school, student loans might seem unavoidable and for some people they are. Make sure to apply for the Free Application for Financial Aid (FAFSA) to see if your family’s income qualifies you for free school through Pell Grants or other benefits like Work Study positions. The key with student loans is to take the smallest amount possible and only if you absolutely have to. If you are offered a loan of $3,000 but you only need $1,000, only take that $1,000! Use your summer months off to work full-time or at least part-time and save, save, save. Then, try working while you are in school as well. The more money you take now, the more money you will owe later so don’t borrow more than is necessary. And don’t try to live off of your student loans. Another option if you can afford it, is to pay as much as you can upfront and then do a payment plan for the rest to pay it off throughout the semester. This may not be feasible for you but if you can, it is an option. There are also tons of scholarships out there, so be sure to take the time to apply for as many as you can. A few small scholarships can really make a difference over the course of several semesters of book and tuition expenses.

Something else that can help you during school is saving and budgeting. Take about an hour or so and make a list of all your expenses and separate them into fixed and flexible expenses. Fixed expenses would be things like your rent, your phone bill, or Netflix, things that are consistent. Flexible expenses are things that can vary such as electricity and other utilities or groceries. Then take a look at your flexible expenses and for each one, take note as to about how much you spend each month. For example, I noticed that when I got married, we were spending about $100 every time we went grocery shopping which was every two weeks. After that, I began budgeting $100 for groceries every paycheck. Budgeting can also help you feel less stressed about your finances because you know what to expect and can plan for it. Another thing I do that helps me feel less stressed about money is to break down payments. For example, if I get paid twice a month and I know my rent is say $500, I will save $250 from each paycheck to make it more manageable and not so overwhelming. In fact, Dave has a program called EveryDollar that’s designed to help you keep track of everything and is a zero based budget, meaning that you give every dollar a purpose so you know where it’s going.

One way to make sure the cash you need for your necessities is set aside and accounted for beforehand is by actually opening up multiple checking or savings accounts. Did you realize you can have more than one checking and one savings account at your bank? In fact, you can have as many as you want! A great method for saving for multiple expenses and ensuring you have the funds, is by creating a separate account for rent, car payment, cell phone, savings, utilities, groceries and spending (for when you want to buy a little something special for yourself), and anything else. As your income grows, you can add accounts for vacation funds, gifts (for when the holidays roll around), maintenance (in case your car or home needs work), and more. Then, every paycheck, take some time to sit down and actually divide out the money from that check. If you get paid twice a month (on average) put half of your rent money into the rent account, then, divide out the amount you will need for the rest depending on when the bill is due. You can add $10 a check to spending and any other account you want to see grow for a future purchase, and even though it doesn’t seem like much now, you will get to watch it grow if you practice some patients and don’t spend it all every check. Know how much you have, how much you will need until you get paid again and set it aside to assign those funds to a specific purchase. This prevents stress and things like rent, your phone bill and even when the holidays come around. Instead of saying, “I can’t buy anything until payday” you will have thought ahead and already saved for the upcoming expense and even have money pre-assigned and set aside.

Thinking ahead and not living paycheck to paycheck will make your life a whole lot easier and more financially productive. You may only make enough to pay your essentials, so you sort of are living paycheck to paycheck. But, there is always something you can do to cut back so that you do have a small amount going into a savings account each pay period. For example, was that Starbucks really necessary? Do you need to go out for lunch everyday between classes? Do you really need a Netflix, Hulu, Disney+ and Spotify account? Instead, avoid nickeling-and-diming your bank account with minimal, but unnecessary purchases, like that fancy coffee, going out to eat, and unnecessary luxuries like all these popular streaming services. Instead, buy your own coffee and spruce it up with some flavored syrups, split Netflix with a friend if you must have it, and buy some bread, peanut butter and jelly to save a whole lot on lunches.

Always make sure to save at least a small percentage of your paycheck every time you get paid and don’t touch that savings account unless you have to. Even if it is only $25 or even less than that, save something. Saving will help when emergencies arise and can help limit the debt that you might accrue. One more tip is to look at your bills and write down when each of them are due, plan it out accordingly, and keep track of what days you get paid so you know which bills will be paid with which paycheck and have an idea of how much you’ll have left.

As you get used to managing money on your own, it can also help to take on some of Grandma’s old-fashioned habits. Stop by your bank and pick up a paper check register or keep a fancy spreadsheet on your Google Sheets app on your phone. Then, balance your “checkbook” even if you don’t have checks. Keep a running total of the amount of money you have in your checking account, and every time you spend money, deduct that amount from the total. That way you always know how much you have in your account, without having to check the balance on your bank app. This is also a good method to make sure you aren’t spending money you don’t have and realizing you won’t have enough for rent, or what have you when you need it. Seeing your total right in front of you and everything you have spent, also makes it a little bit easier to resist the temptation to buy that unnecessary Starbucks or other purchase.

Now about credit cards. You will be told that a credit card is necessary in today’s world, that you cannot get by without one and that you need it to help you build a good credit score. Credit cards a good way to trick people into going into debt and credit cards make it super easy to spend more and more and get further into debt. Dave Ramsey instead recommends the first baby step: saving a $1,000 emergency fund. This is a tough step but if you can do this, you can do all the other steps. The way I think about this money is it’s replacing an emergency credit card with cash that’s yours so that the card you wanted for emergencies, you no longer need because you have a safety net in place. The only reason I considered getting a credit card is for emergencies but with this money, I don’t need one anymore. This money will also give you peace of mind because now you know, if you have an emergency, you won’t have to cut your grocery bill short because you have that money already set aside. With that being said, the choice is yours. In another article we outline how you should use a credit card if you choose to get one: https://isu.edu/cob/blog/how-to-budget-as-a-college-student.html It is true that having a credit score makes buying things like a home easier but you can also purchase a home without it too: https://www.daveramsey.com/blog/no-credit-score-no-home

One thing Dave Ramsey really stresses is that having no credit score is a lot different from having a low credit score. Having no credit score simply means you have never borrowed any money (meaning gone into debt) whereas having a low credit score means you borrowed money and weren’t responsible with it. Ramsey expounds on this idea more in this article: https://www.daveramsey.com/blog/no-credit-vs-bad-credit

If you choose to have a credit card, treat it like it’s a debit card. In other words, if you don’t have the money you are spending on your credit card sitting in your bank account right now… then you should not be spending that money. That’s how you get into debt and can eventually get into trouble because you are living outside of your means. Obviously, as a student, you may need to buy a new car and you don’t have $6,000 - $10,000 sitting in your account, so a car loan is necessary. But, any other purchase outside of that that you are trying to use a credit card for because you don’t have the cash, is probably not a good idea and is irresponsible. Credit cards can be used to build your credit, to earn points and therefore extra cash, but they are most responsibly and safely used as a secondary debit card. As a quick tip, you may use your credit card to buy gas, groceries, etc. but then immediately pay off those purchases with the cash you have in your account to avoid getting charged interest and still benefit from earning points or a good credit score.

The next step would be to pay off all of your debt using the debt snowball method. What that means is that you take all of your debt that you have, except for your mortgage if you have one, and you start with the smallest debt and put everything you can into that debt while making minimum payments on all the others. Once that is paid off, you then roll the money over into the next debt until that is paid off and so on and so forth. Let’s say you bought a car a couple of years ago and took out loan for $3,000 at seven percent interest for three years and you still owe $1,500 on that loan meaning your monthly payment would be about $103. You also opened a credit card and you owe $150 and finally, you’ve got your student loans which you owe $2,000. Your minimum payment for your credit card is about $25 and your student loans you aren’t required to pay yet but you’d like to get started on them anyway and can pay $40 a month for them. You would first begin with your credit card and let’s say you have an extra $40 a month you can put towards it. Let’s put it in a table.

|

Bill Name |

Amount Owed |

Minimum Payment |

Maximum Payment you can make |

|

Credit |

$150 |

$25 |

$65 |

|

Car |

$1,500 |

$103 |

$103 |

|

Loans |

$2,000 |

$0 |

$40 (You don’t have to but you want to get started) |

Now once you’ve paid off that credit card debt, you roll the money over into the car loan.

|

Bill Name |

Amount Owed |

Minimum Payment |

Maximum Payment you can make |

|

Credit |

$150 |

$25 |

$65 |

|

Car |

$1,500 |

$103 |

$168 |

|

Loans |

$2,000 |

$0 |

$40 |

And you just keep going until you’ve paid off all of your debt. Now that you’ve paid off all of that debt, step number three is to start saving three to six months worth of expenses. This means everything you spend in a given month on the necessities. This is when you sit down and total up everything you spend, including things like your phone and internet bill because let’s be honest, having access to the internet is a necessity nowadays. Keep in mind if that is something you’d like to cut out or something you can’t afford, libraries generally will have free wi-fi and/or computers available to anyone who has a library card. Once you’ve done that, multiply that number by three and that is the minimum you should save. Of course, as a college student, you may not be able to do this. Personally, my husband and I aren’t able to simply because we save that money for college so if you can’t do this step yet, that’s okay.

Step number four: Invest 15 percent of your income into your retirement. If you’ve successfully completed steps one - three, great! Now it’s time to look at retirement and to start saving for that. Retirement is important and according to Northwestern Mutual’s 2018 Planning & Progress Study, a survey done of 2,003 participants, 21 percent of adults have nothing saved for retirement and it’s stressing us out. The sooner you can save for retirement, the better. And we totally get it, that may not be a reality for you right now and that’s okay. But once you’re established, you’ve knocked out all your debt and saved some money for emergencies, focus your sights on retirement. The more you save for retirement, the earlier you can retire or the more comfortably you can retire, depending on what your preference is. The biggest reason that saving for retirement is important is because retirement usually happens when you can’t or don’t want to work anymore and it’s designed to take care of you in your old age. Dave Ramsey breaks it down in this article: https://www.daveramsey.com/blog/how-to-retire-early

Step number five is to save for your children’s college fund. If you don’t have kids and aren’t planning on having any then you can probably skip this step. But if you have kids, this is important. Why? Because it is becoming increasingly more difficult for young people to afford college on their own. In fact, according to a study conducted my TD Ameritrade of 3,000 people including 1,000 students who are in the Gen-Z category (ages 15-21) 1,000 Millennials (ages 22-28) and 1,000 parents (ages 30-60) “[j]ust over one in four young millennials say they are delaying college due to the cost, according to the TD Ameritrade study. That’s up 7 percent from 2017. And 73 percent of Gen Z and young Americans say “they chose or would choose a less expensive college to avoid debt,” the study found.” (MarketWatch) Another factor is that college costs are on the rise. The average college cost in 2019 is $10,116 for an in-state public school, $22,577 for a public out-of-state school, and $36,801 for a private school according to US News. The average minimum wage across all 50 states is $9 meaning that if you worked part-time (as most students do) that you would only earn $10,800 before taxes in a given year. If you didn’t spend any of that money, you would barely squeak by. Now, of course there are scholarships (which we heavily encourage you to apply for) but even those aren’t guaranteed to students. If you aren’t married, the FAFSA application will take your parents income into account and if they earn above a certain threshold you will only be offered loans. I’m not saying your kids shouldn’t work at all (having a job during the summer and a part-time one during school helps a lot) but doing this will remove a lot of the stress you went through and will limit if not eliminate all of the debt they would otherwise have after they graduate.

Step number six: Pay off your home. This is the key step to having a great retirement. You won’t have to worry about being evicted, foreclosure, or making payments because this house will be yours. This should also be the last piece of debt that you pay off as it is the only thing Dave Ramsey really says you can go into debt for. He does say you should at least save up a 10 percent down payment though 20 percent is even better because you can avoid private mortgage insurance which is essentially insurance for the lender if you stop making payments. If you want more information on how to buy a house, check out this article: https://www.daveramsey.com/blog/how-to-buy-a-house

Step Number seven: Build wealth and give. This is the point that everyone would like to reach where you just keep building your wealth and helping others. After you’ve followed all the other steps, the last thing you can really do is just keep saving for retirement, for any trips you’d like to take or for anything really. Being in this position also allows you to help others if you so wish.

Even if you’re a college student who’s just starting out or someone who’s already finished and well on their way, these tips can still help everyone make smarter money decisions.

https://isu.edu/cob/blog/how-to-budget-as-a-college-student.html

https://www.marketwatch.com/story/half-of-young-americans-say-college-isnt-necessary-2019-08-06