Volunteer Tax Program Finds Learning Benefits in COVID Restrictions

April 15, 2021

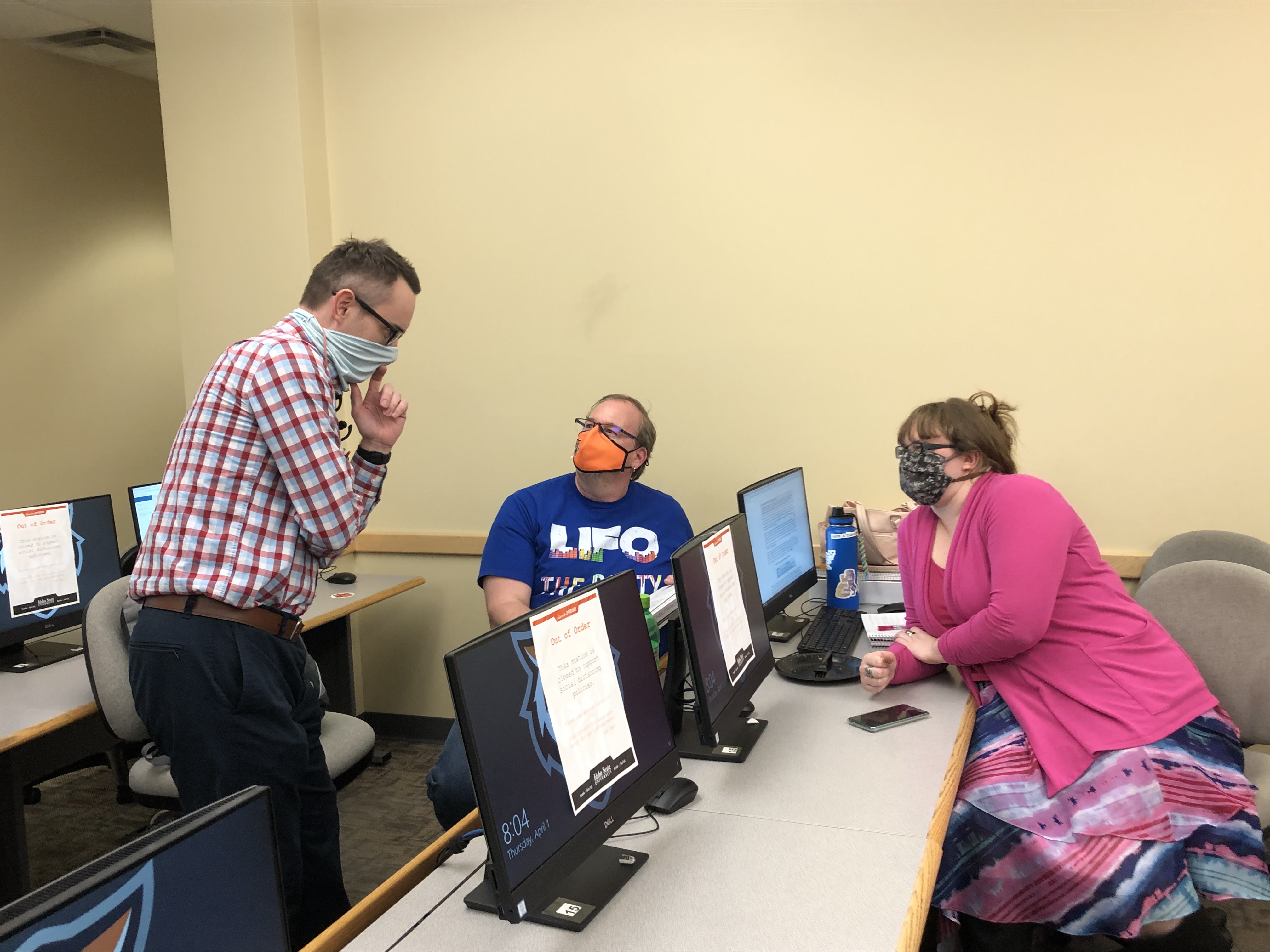

Like most events over the past year, students participating in the Volunteer Income Tax Assistance (VITA) program had to do things a little differently this semester, but the results of these changes proved to be quite valuable.

VITA, a program that offers students and community members free tax preparation, has been a major real-world opportunity for College of Business accounting students for many years.

“Our first goal this year was to keep the students and community safe from COVID-19,” said program advisor and clinical accounting professor, Dr. Dawn Konicek.

In a typical year, clients would sit beside students while the taxes were being completed. This year, clients sat in the hallways with at least 6 feet of space between them. A greeter would collect paperwork from clients and add it to a file for student preparers to complete in the next room. The taxes were then reviewed by a site coordinator and signed off on by the clients. Konicek said the process was so effective, she is considering adopting a similar setup next year.

“This process ended up being more efficient because the room was not overwhelmed with too many people,” said Konicek. “The students also felt less pressure and less stress without the client sitting beside them.”

This year, Idaho State students filed about 480 tax returns. It wasn’t as many as some years, but close, Konicek said.

Because of the more relaxed atmosphere of the preparation room, students had the opportunity to ask more questions.

“Due to our process change, I believe the students learned more this year,” noted Konicek. “Students were not under so much pressure; I was also able to answer more questions and cater more toward students.”

Overall, Konicek said about 20 students worked as tax preparers, including some non-accounting majors.

“I encourage non-accounting majors to participate. Everyone has to complete a tax return; hence everyone should have exposure to this type of learning experience.” Konicek said. “Those who prepare taxes learn the technicalities of taxes and they also learn to volunteer and give back to the communities that support them. This service also helps those who cannot afford to have their taxes filed by an accountant.”

The VITA program runs every tax season from January until March or April.

Categories: